Short-Term Rentals Pump $75-million into the Local Economy. But What Else Do They Do?

An economic impact study shows big financial benefits of Airbnbs and other short-term rentals. But a city of Brevard group asks if the report understates their downsides.

BREVARD — The City of Brevard’s Short-Term Rental Task Force accepted the main finding of a new report about these properties — their massive impact on the local economy.

But several members took issue with some of the conclusions in the study, paid for with a grant from the Land of Sky Association of Realtors — especially the claim that the soaring demand for short-term stays has done little to contribute to the county’s affordable housing crunch.

“The data . . . is really great and helpful for our purposes,” City Council member Aaron Baker, the co-chair of the Task Force, said at the group’s Thursday meeting, but “we should focus on the data rather than some of the analysis and narrative that is built around it.”

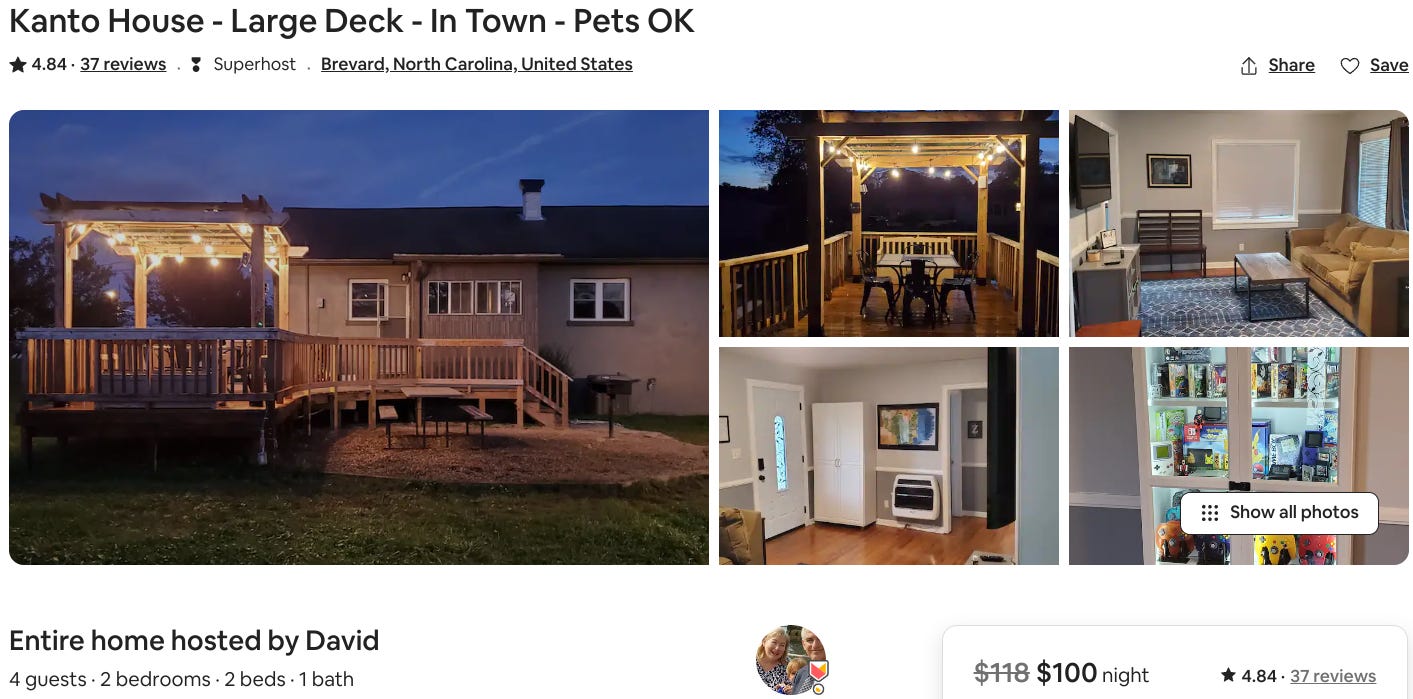

Visitors to Transylvania County staying in short-term rentals — apartments or homes advertised on websites such as Airbnb or Vrbo, or by local Realtors — spent $29.1 million in rental fees for these accommodations in 2020, the report found.

They spent another $33.1 million at restaurants, bars, shops, and for entertainment and transportation, according to the study. Add in the “ripple” effects, all the way out to cab drivers spending on gasoline and cleaning services paying for supplies, and these visitors’ total economic impact came to $75.2 million, the report said.

“I hope we can all agree that the economic activity is positive,” said Matt Allen, of Land of Sky, who presented the report at the meeting.

The Task Force members did agree, but several of them took issue with some of the conclusions of the report, compiled by Matt Curtis, owner of Smart City Policy Group, who “used to do government affairs for Vrbo and HomeAway,” Allen said.

The report’s analysis of short-term rentals on the local housing market, performed by a separate company, RCLCO, concluded that “there is limited evidence of causation between the growing STR market (representing less than 6% of total housing stock) and the County’s housing market.”

Instead, Allen said, the main “culprit” in increasing housing prices — and Transylvania’s acute shortage of affordable housing — is limited inventory.

“We don’t build enough housing,” he said. “If we had more housing, we could house more people and prices would go down.”

But Baker pointed to data in RCLCO’s section of the report that countered this conclusion. The correlation between median sales prices and total housing units is indeed high, .81 out of a maximum of 1, he said.

However, the correlation between that price and the number of active listings of short-term rentals was also “pretty high,” Baker said, .71.

“(RCLCO analysts) pass that off as not that big a deal,” he said. “I was a little confused, because there was that disconnect there . . . That tells me the opposite story of what they are saying.”

Allen echoed another of the report’s findings, that short-term rentals allow a use for some of the more than 4,000 second homes in the county’s total of about 20,000 housing units.

These second homes are typically not viable as long-term rentals, and if they weren’t offered as vacation rentals, would likely sit empty and provide no benefit to the local economy, he said.

None of the Task Force members raised objections to that conclusion, but did dispute another finding, that these homes “fill a void,” Allen said. “They provide an additional place to stay where there aren't enough hotels.”

Dee Dee Perkins, a member of the Task Force and the board of the Transylvania County Tourism Development Authority, pointed to other numbers suggesting short-term rentals take business from hotels and motels. The amount of occupancy tax collected from short-term rentals recently surpassed the amount generated by these “traditional accommodations,” she said.

“That differential shows that there are just more people staying in short-term rentals rather than traditional accommodations . . . Their overall occupancies are not as strong (as short-term rentals’),” she said.

Aaron Bland, a Task Force member and Brevard’s assistant planning director, asked why the report, in its discussion on the limited housing stock, relied on data from the federal Department of Housing and Urban Development for a chart that showed no single-family home permits were issued in the county in 2020.

They could have easily accessed county records, Bland said, and these show that nearly 120 permits for single-family homes were issued in 2020. Also, that number reached 177 in 2021, the highest total in more than a decade, Mike Owen, director of the county’s Department of Building Permitting and Enforcement, said in January.

Allen said he would forward all questions to Curtis, who did not respond to a Thursday email from NewsBeat.

The report is part of a larger effort by the Task Force, which was formed last year in the face of growing concerns about short-term rentals, to gather data about the issue before recommending what, if anything, the city should do to regulate the market.

Last week, the Brevard City Council agreed to provide $10,000 for the Task Force to collect more information about short-term rentals — a survey of residents expected to be complete in December or January.

“What we’re looking for is that anecdotal information,” said the group’s co-chair, Council member Geraldine Dinkins. “Where we ask people how they feel about short-term rentals.”

Or not how they feel exactly, Baker said. “I would use, ‘what their experience with short-term rentals has been in their day-to-day life.’ I would hope the survey goes to the heart of that.”

Email: brevardnewsbeat@gmail.com

Ah, lots to unpack here. First – the actual report and its findings. Most people who’ve done any independent research (Google or otherwise) shouldn’t be shocked to find that the economic impacts of STRs in virtually any area are unbelievably positive. So, it’s no surprise the same is true for Brevard. It looks like most of the STR Task Force and City Council members were on board with that finding as it is basically an incontrovertible fact, and arguing to the contrary would only reveal more of their bias. Predictably, their opinions on the report’s findings concerning the effect STRs have on housing prices is where they seem to diverge with the experts they commissioned to study it. Why predictably? Well, because before the study was even conducted, several of those the author interviewed for this piece were publicly clamoring for the regulation of STRs (banning them out right, re-zoning so no future STRs would be permitted, etc.) before they had ANY data presented to them on the matter. They had their minds made up that STRs were the reason behind the “affordability crisis”, and were already offering solutions to a problem that was yet to be supported by any actual data. Don’t believe me? Just do a quick search on this author’s Substack. Or Facebook or Google. Several of these people even made such positions a part of their platform while running for City Council.

The unmistakable irony of the arguments presented in the article border on satire. Aaron Baker is quoted as saying “we should focus on the data rather than some of the analysis and narrative that is built around it.” Ignoring his own advice, he provided his own analysis that the correlation between the median sales price and the number of active STRs was “pretty high” at .71, and introduced the narrative that such correlation is “the opposite story of what they are saying” in the report. Mr. Baker’s analysis and narrative that this is “pretty high” may or may not be correct. Without writing a treatise on the matter, whether correlation is “strong” can vary from field to field. I’m not an expert on housing prices and the impact of STRs on them, so I won’t opine as to whether .71 is “pretty high.” Those conducting the study presumably are, which is why they were hired, so I’ll defer to their analysis of the matter – something those interviewed refuse to do because it is in direct contradiction of the propaganda some of them have pushed for two years or more now.

Baker’s own analysis is that there is high correlation here, and the analysis of the experts is off. But after securing a report on my own (it was neither provided by the author, nor was it directly quoted), I can confirm the report never concludes that there is low correlation between housing prices and the number of STRs in the county. Instead, the report says, “[w]hile there is a positive correlation between the median sales price and STR active listings, … there is limited evidence of causation between STR active listings and housing prices.” See page 21 of the report. Baker’s own analysis (in which he urges us not to engage) that the analysts “pass[ed] that off as not that big a deal” appears to confuse correlation with causation. Baker ignores the fact that just because there appears to be a relationship between housing prices and the number of STRs in the county, does NOT mean that one causes the other. This is Statistics 101. So, while there may be some sign of a positive relationship between the two (as the report clearly concedes), it does NOT follow that the presence of STRs directly causes housing prices to rise.

The report also indicated that there were six other factors which were determined to impact housing prices to a greater degree than the number of STRs. The author only mentioned one – total housing units – and did not question any of those he interviewed about any other such factors.

Mr. Baker suggested that “we should focus on the data”, yet the City’s plan is to spend $10,000 to retrieve anecdotal data (“what we’re looking for is that anecdotal information”), which by definition is unscientific data, via a glorified opinion poll from individuals who choose to respond to a survey. If we made policy decisions based off anecdotal data, none of us would have received COVID-19 vaccines, and most would never step foot on another airplane or get behind the wheel of a car. You can’t make this up.

The bias here is clear. Multiple members of City Council, as well as members of the STR Task Force, have gone on record before this study was ever commissioned as wanting to shut down STRs. They engaged experts to study the relationship between STRs and housing prices, and the data doesn’t support the propaganda they’ve pushed, so now they’re pivoting. Now that they know the data does not support the premise that STRs are behind an “affordability crisis” and, therefore, they cannot justify an STR ban on such grounds, they are embarking on a what is a taxpayer funded witch-hunt to secure unreliable anecdotal information about how STRs make people “feel.” These folks have tried relentlessly to shape your opinion of STRs before this opinion for years before this poll was ever suggested. Don’t be fooled, Brevard. Read the report – not the propaganda.

If all the data referenced by the task force members in their discussion and their quotes used in this article are from 2020, I think a pretty significant consideration was missed: 2020 was a disastrous year for traditional hotels / motels. Remember when people feared going into public places? People escaping urban areas to homes in rural mountain regions was a big part of the 2020-’21 Covid boom for STRs in our county.

With that in mind, it’s not surprising that the occupancy taxes collected from STRs in 2020 surpassed the amount generated by “traditional accommodations.”

I think 2022 will be a more interesting year to compare the source of occupancy taxes, as the Covid escape boom is clearly over. Plus the current state of the economy is pushing STR pricing down, demand has softened, and hotels/motels are not scary places anymore.